As crypto trading gets more popular in India, the appropriate way to estimate your taxable income from crypto earnings can be a real pain in the neck. Fortunately, there are various Indian crypto tax calculation software that are designed to facilitate the process of crypto tax calculation. Whether you are searching for a Binance tax calculator, or a Wazirx tax calculator or the most suitable free crypto tax software, this article will help you get the most appropriate crypto tax calculator and enlighten you on why using a crypto tax calculator is better than manual calculation. So, Let’s explore some of the best options available:Let’s explore some of the best options available:

The Best Indian Crypto Tax Calculators You Need to Know About

Here are some of the best crypto taxes calculator that will helps calculate your taxes with ease:

1. Catax

Catax is one of the most preferred crypto in the Indian crypto market. It is super user-friendly and guides you track your taxes accurately. Catax complies with Indian Tax Laws, so you have nothing to worry about, while you file your taxes. Whether you’re a beginner in crypto or experienced crypto trader, Catax is a powerful tool for you to easily manage your crypto taxes. Even more, it assists in calculating your Binance tax effortlessly as well.

2. ClearTax

ClearTax is also a good option for cryptocurrency traders in India. It is quite popular for its extensive tax solutions. The ClearTax crypto tax calculator does all the complex work for figuring out your profit and loss. Also, the platform is easy to use to generate detailed reports to ensure that you cover all tax responsibilities with no stress.

3. Taxnode

The Taxnode app is built for Indian users. It synchronizes with your cryptocurrency wallets and accounts, thus, bringing in your transaction history automatically. Taxnode will then produce the correct tax reports and help save more time. One of the main reason for its popularity among Indian crypto enthusiasts is its simplicity and user-friendliness.

4. Koinx

Koinx is a tight competitor in the Indian market. It supports multi-exchange and wallets, so you can keep track of all your transactions in one place. With Koinx, be assured that your tax calculations are accurate and comply with Indian tax laws. Regardless of whether you are a beginner or an experienced trader, Koinx makes your crypto taxes manageable.

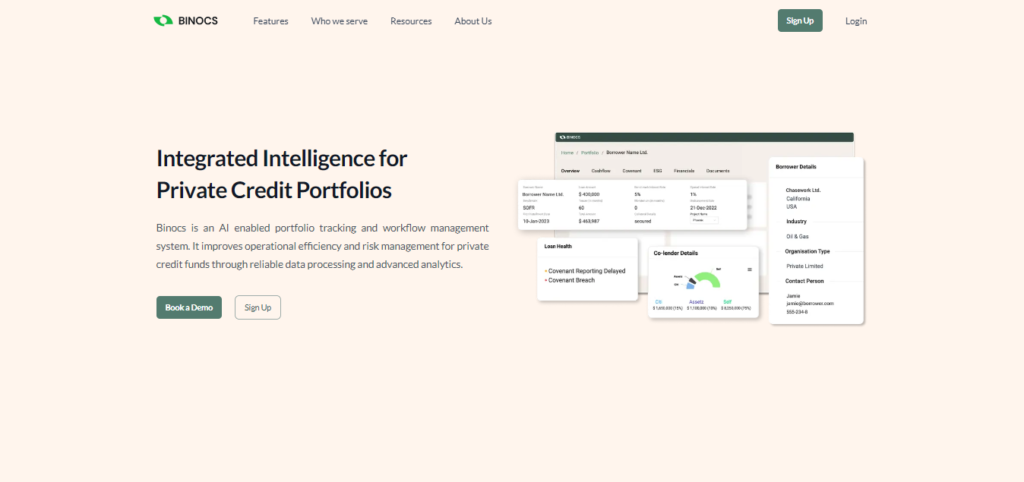

5. Binocs

Binocs is a new crypto-tax calculator that enables Indian traders to comply with the tax laws. Also, it shows you all your crypto transactions in a clear picture and does the tax calculations for you precisely. To free you from the crypto taxation nuances, Binocs will be doing the math in the background while you focus on trading.

Why use crypto tax calculators instead of manual calculations?

For people who are not familiar with the crypto worlds, doing the calculations of their crypto taxes manually might be an overwhelming task and full of mistakes. Therefore, here’s why using a crypto tax calculator is a better idea: Here’s why using a crypto tax calculator is a better idea:

Accuracy: Crypto tax calculators purport to help you with spot-on tax calculations. So, they apply all applicable tax provisions and laws, thereby minimizing the chance of mistakes having been made.

Time-saving: The determination of crypto tax by your own means can be a very time-consuming process. A crypto tax calculator will do the work on your behalf, saving you quite some time.

Ease of Use: The interface should be simple and intuitive. These buttons and tabs help you navigate through the website or application. Moreover, you don’t need to be a tax expert because the platform is user-friendly, allowing you to complete your calculations with minimal effort.

Comprehensive Reporting: Crypto tax calculators are able to prepare reports of each of your transactions and thus help you understand much better, what you must declare as a tax obligation.

Compliance: Tax calculator for crypto is the tool that enables you to comply with the Indian law and avoid penalties for not filing the tax returns.

How to Decide which Tax Calculator is the Best

After looking at so many options, one can definitely have a hard time making a choice about the crypto tax calculator that is right for them. Here are some things to keep in mind: Here are some things to keep in mind:

User-Friendly Interface:

- A computer program that properly calculates the crypto-currency taxes should be user friendly. However, the app should help you import all your transactions, create reports, and calculate tax returns without problems.

- Digital assets can be included in this kind of service that will interact with exchanges and wallets.

- One of the main features would be to select a crypto tax calculator that is compatible with several exchanges and wallets. This will make the process simpler, and all your transactions will be in one place so you can track them and be sure that the calculations you make on your income tax will be correct.

Customer Support: Therefore, try to find yourself a crypto tax calculator that has the best customer service. If you have any questions or difficulties, you will probably find quick assistance.

Cost: Think about the cost of a tax calculator on crypto. Indeed, some are free of charge, however, others have to be paid for. Select a calculator like catax that meets your needs and fits your budget. The calculator should have a nice price as well.

FAQs (Frequently Asked Questions)

Yes, some crypto tax calculators, like Catax are free. However, paid versions often offer more features and better customer support. Evaluate your needs and budget to choose the right one.

Absolutely, Many crypto tax calculators, like Catax and Taxnode, support multiple exchanges and wallets, making it easier to track all your transactions in one place.

Crypto tax calculators are designed to apply all applicable Indian tax laws and provisions. Also, they generate accurate reports, ensuring you meet all legal requirements and avoid penalties

Good crypto tax calculators like Catax offer responsive customer support. Look for options like Catax and ClearTax, which provide quick assistance to resolve any issues or answer questions. So, book your free consultation now.