Bitcoin options and crypto options are a type of derivatives contract that gives investors the chance to speculate on market movements to make a profit – and they’re becoming more and more popular in the bitcoin trade. This guide will take you through the essentials of Bitcoin and crypto options. Explaining what they are, how they work, and sharing some smart strategies to navigate the crypto trade waters successfully. Let’s get started on this exciting journey together!

- What Exactly are crypto options?

- what are the different types of options contracts?

- American vs. European options

- Understand Call options vs. put options

- Are there different types of options contracts?

- Call options vs. put options

- What is an option premium?

- Options terminology: ITM vs. OTM vs. ATM

- What’s an options position?

- Strategies for Success in Crypto Option Trade

- Simplify your Crypto option Taxation with Catax

What Exactly are crypto options?

crypto options are derivative contracts that give you, the investor, the power to buy or sell a specific cryptocurrency, like Bitcoin at a set price on a predetermined date. These tools are fantastic for capitalizing on market movements without directly owning the underlying crypto asset.

The concept can be a little confusing to newcomers, and there’s quite a bit of jargon to get through so let’s break it down.

what are the different types of options contracts?

Definitely! In the realm of crypto options, we’ve got two key players: American options and European options.

Diving into bitcoin trading, both these options offer a neat deal. They give you the power to decide if you want to buy or sell a crypto asset at a future date, locked in at today’s agreed-upon price. This future date is known as the expiration date and the agreed-upon price? That’s your strike price.

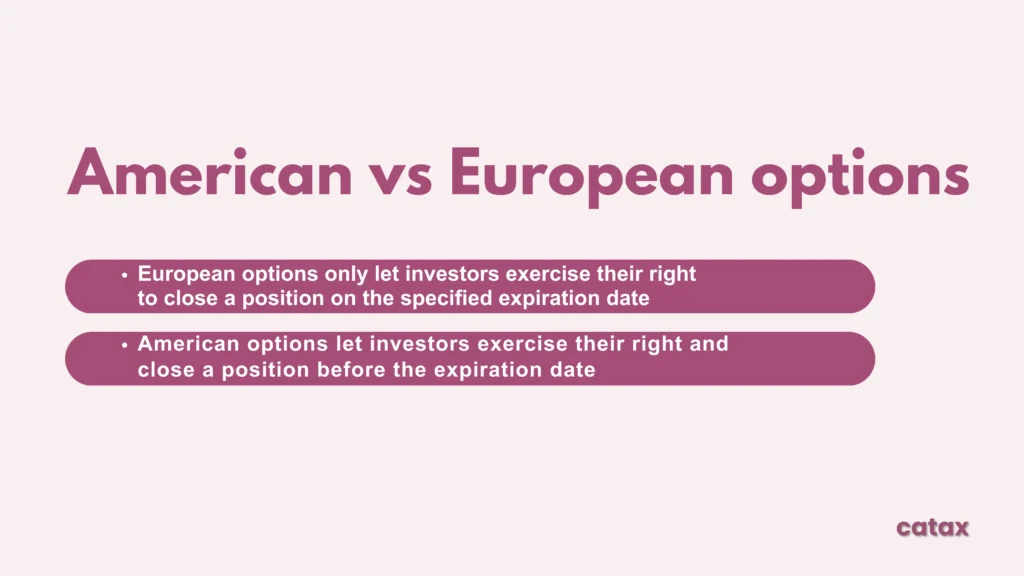

American vs. European options

Traders often favor American options due to their flexibility. These options grant you the right to buy or sell at any point before they expire, providing maximum control over your investments.

In contrast, European options restrict exercise rights until the expiration date. While their stricter nature may not be as alluring, they are often more affordable and are generally seen as a safer option, making them a valuable starting point for those new to the world of cryptocurrency trading.

Moreover, European options are often viewed as a safer choice by certain bitcoin traders. This is due to fact that the expiration date is predetermined, making it simpler to calculate potential losses or gains when entering a position. As a result, utilizing European options may be more manageable and approachable for novice traders who are still unfamiliar with bitcoin options contracts.

Understand Call options vs. put options

Bitcoin options and crypto options are a type of derivatives contract that gives investors the chance to speculate on market movements to make a profit – and they’re becoming more and more popular in the bitcoin trade. This guide will take you through the essentials of Bitcoin and crypto options. Explaining what they are, how they work, and sharing some smart strategies to navigate the crypto trade waters successfully. Let’s get started on this exciting journey together!

Are there different types of options contracts?

Absolutely! When it comes to crypto options, there are two primary categories to consider: American options and European options.

Regarding bitcoin trading, both American and European options offer a valuable contract that grants you the choice to either buy or sell an asset on a specific date and at a set price, commonly referred to as the expiration date and strike price.

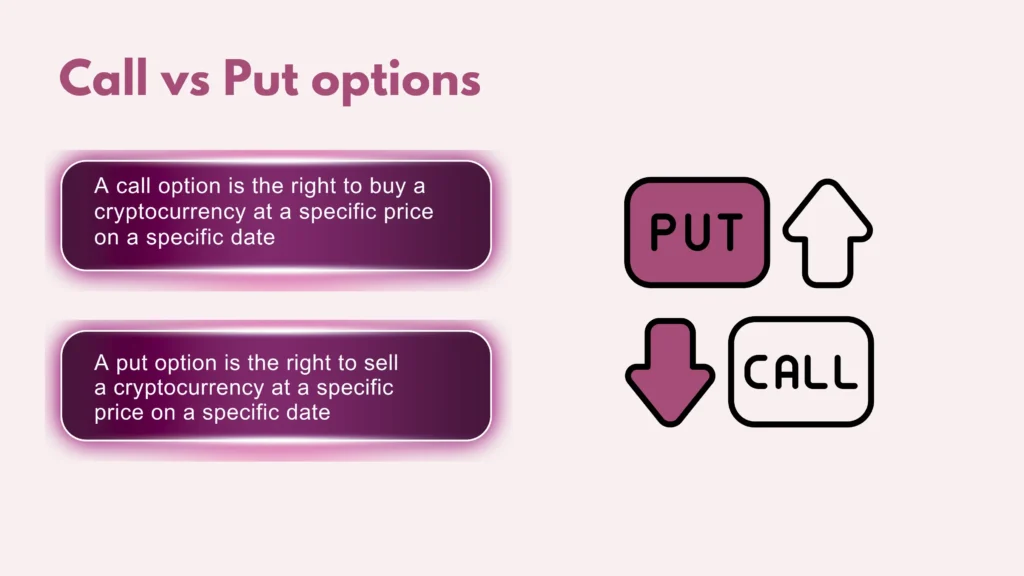

Call options vs. put options

On top of all the trading choices we’ve explored, there are a couple more terms you’ll likely run into in the bitcoin trading scene: call and put options. Think of these as the trading world’s shorthand for getting the green light to either buy (call options) or wave goodbye (put options) to an asset in the bitcoin marketplace.

Here’s the lowdown:

- A call option is like having a golden ticket to buy an asset at a price you lock in today, but on a future date.

- A put option, on the flip side, is your ticket to sell an asset at a predetermined price, again on a date that’s down the road.

What is an option premium?

In the lively world of crypto trading, consider the option premium as your entry pass to the excitement. It’s what you pay right off the bat for the opportunity to either snap up or sell off a cryptocurrency at a predetermined future date. This fee is non-refundable, meaning whether you decide to go through with the trade or not, the premium is a sunk cost.

Now, you might wonder, why does the cost of this entry pass fluctuate? Imagine the crypto market as a high-speed roller coaster—its twists and turns represent market volatility. When the ride gets wilder, the premium climbs because the potential for making (or losing) money increases. Holding onto your option for more time? That’s like extending your stay at the amusement park; you’re paying extra for the prolonged chance to see the market swing in your favor. Essentially, the option premium is your key to joining the thrilling crypto trade arena, with its price mirroring the blend of risks and chances waiting for you.

In particular, the price of a premium is determined by whether the option is ATM, ITM, or OTM.

Options terminology: ITM vs. OTM vs. ATM

In-the-money (ITM), out-of-the-money (OTM), and at-the-money (ATM) relate to the relationship between the current market price of an underlying asset (like a stock) and the strike price of an option. Break down the world of options trading into everyday terms:

In The Money (ITM):

Imagine having a coupon that enables you to purchase your favorite pizza for 10 dollars, but currently in the store it costs 15 dollars. You’re fortunate since the coupon or option allows you to buy at a discount, this is known as “in the money”.

Just picture now flipping it. You could sell a pizza that you have for $10 while in the market it is going at $7 only. You are better off selling it at more than its worth out there.

Out of The Money (OTM):

This time, your $10 pizza coupon does not seem appealing because sellers are offering pizzas for $5. Your special coupon isn’t that special anymore since buying directly is relatively cheaper.

Let’s say you can sell your pizza for $10, but other people are selling theirs for $15. In fact, when the market offers a lower price, up to $15 less, no one will buy your pizza priced at $10.

At The Money (ATM) Explained:

When buying or selling, ‘at the money’ signifies you have a pizza coupon valued at $10, and the current market price for pizza matches that – $10. It’s a point of neutral gain or loss. Your coupon doesn’t offer superb savings nor does it disappoint – it simply equals the going rate.

What’s an options position?

In the world of crypto options, the term “position” plays a central role. First of all, it’s all about starting or wrapping up your engagement with a contract. To begin with, you enter a contract, marking the initiation of your position. Finally, ending your involvement with the contract is considered the termination of that position.

Digging deeper, your position reflects your financial commitment or strategy towards a specific contract. There are four fundamental positions you might find yourself in:

- buy a call option – You’re betting on the crypto’s price to climb.

- sell a call option – You’re offering others the chance to bet on the price increase.

- Again, Buy a call option – It’s another opportunity to speculate on price growth.

- sell for a call option – Here, you’re speculating that the price will fall.

The positions can be utilized for both long and short strategies. To put it simply, going long on a stock means that you believe its price will rise. Conversely, taking a short position is when a trader believes that the price of an asset will decline in value. This strategic model helps traders make decisions amid cryptocurrency trade markets by relying on their expectations as well as financial objectives.

Strategies and Considerations

- Start Small: When dealing with options, always start small while familiarizing yourself with the workings and peculiarities of the market.

- Research is Key: Appreciating Bitcoin’s market dynamics and factors that influence its pricing can boost your trading strategy.

Strategies for Success in Crypto Option Trade

- Begin Conservatively: Start with smaller investments to understand market dynamics.

- Informed Decisions: Stay updated with Bitcoin market trends for strategic trading.

- Risk Management: Allocate funds wisely, never exceeding your financial threshold.

- Engage and Learn: Connect with the trading community for shared knowledge and tips.

- Patience Pays: Long-term success requires patience and continuous learning.

Simplify your Crypto option Taxation with Catax

Sailing through the world of crypto trading is like going on an adventure. It’s exciting but can also be tricky. That’s where Catax comes in, like a helpful friend. Catax makes the confusing part of dealing with crypto taxes simple and easy to understand. You don’t have to worry about following the rules anymore because Catax has got your back. This way, you can focus on making the most out of trading with Bitcoin and other cryptocurrencies, finding calm and confidence on your journey.

No matter if you’re already good at trading or just starting, winning in the crypto world means knowing your stuff, having a smart plan, and using the right tools. Think of Catax as your guide, leading you through the fun and challenging world of crypto trading, helping you reach success and even more.

Explore: