Welcome to a world where you can trade cryptocurrencies freely and without giving away too much about yourself (KYC). Imagine a place where you don’t have to show your ID or fill out long forms just to buy or sell digital coins. This place exists in the world of Non-Kyc crypto exchanges for trading, where your privacy is a priority and trading is as easy as pie.

- Why We Love Non-KYC Exchanges

- List of Top Non KYC Crypto Exchanges for Trading

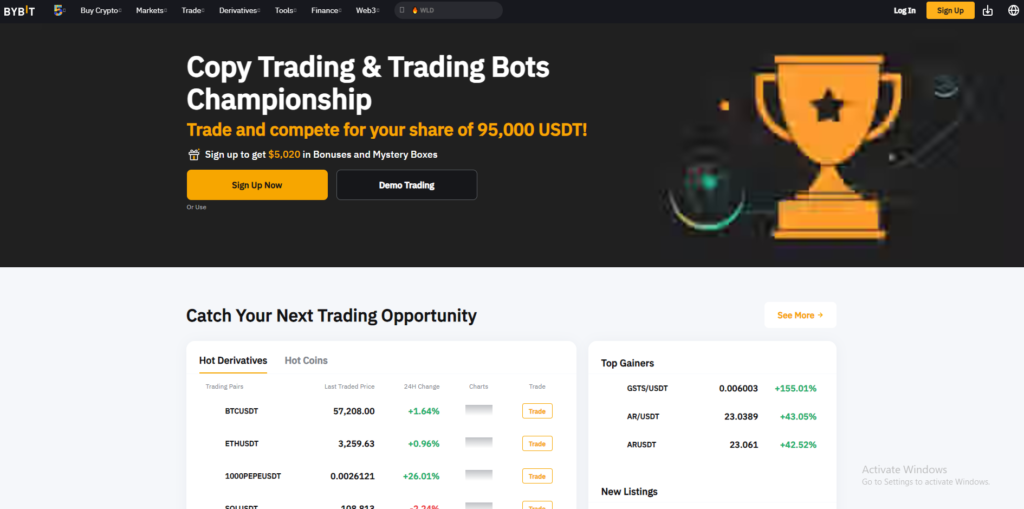

- 1. Bybit – The Global Crypto Powerhouse

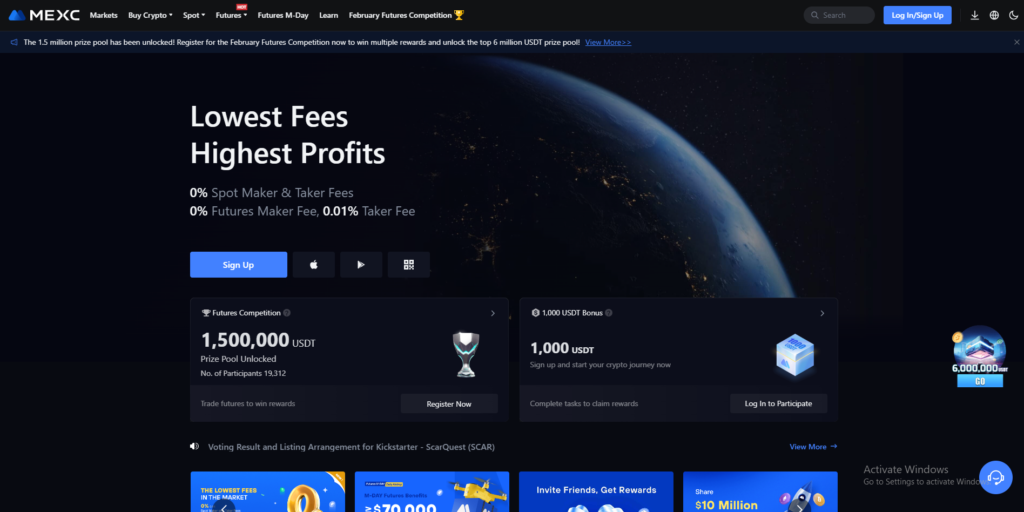

- 2. MEXC – Low Fees Leader

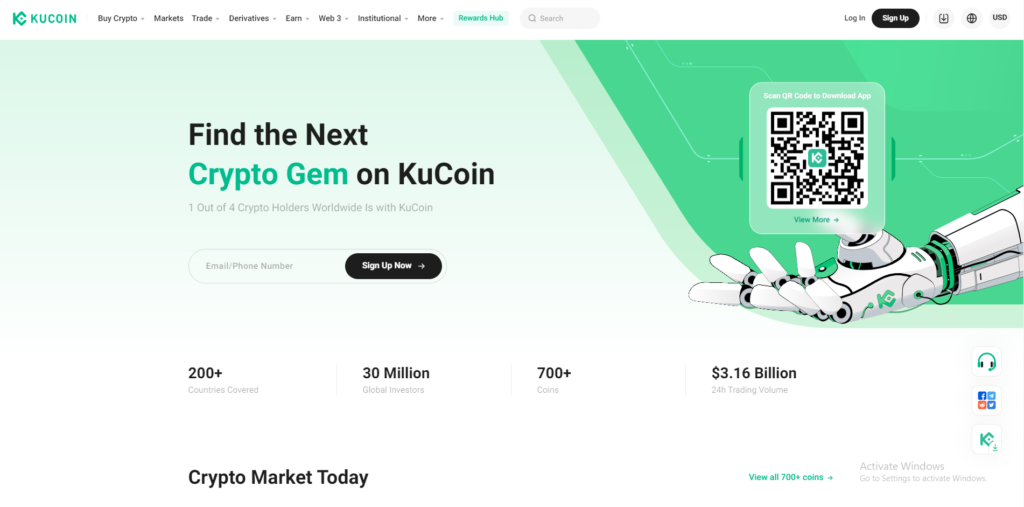

- 3. KuCoin: Exchange with 700+ cryptocurrency

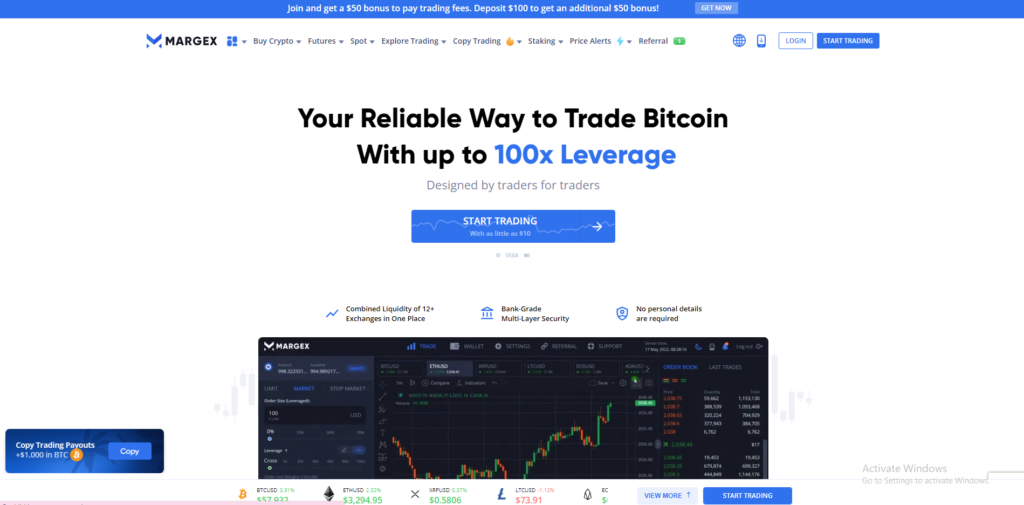

- 4. Margex – Best Low Fees Non-KYC exchange

- 5. Coinex – A centralized exchange with secure and fast trading

- 6. Bitfinex – Trader’s choice for derivatives trading

- 7. Uniswap – decentralized crypto exchange

- 8. Phemex: The Jack-of-All-Trades Platform

- 9. Changelly – No. 1 crypto exchange with swift swap service

- 10. Bisq – decentralized bitcoin exchange with good privacy

- What Makes Non-KYC crypto exchanges Special

- Choosing the Right Non-KYC crypto exchanges

- Tips for Trading on Non-KYC crypto exchanges

- Trade without the hassle make your profit

Why We Love Non-KYC Exchanges

Let’s break down why these Non-Kyc crypto exchanges for trading for trading are so cool. First off, they’re like secret clubs where you can keep your identity hidden. In today’s world, where everyone wants your personal details, these places give you a break from all that. Plus, getting started is super fast because you don’t have to go through all the usual checks.

A Private Hideout: For those who really care about keeping their things private, Non-KYC crypto exchanges are like hidden gems. They let you trade without having to tell the world who you are.

Jump Right In: And the best part? You can start trading in no time. Without all the paperwork, you’re ready to go almost immediately. It’s perfect for grabbing those good deals fast.

List of Top Non KYC Crypto Exchanges for Trading

- Bybit: Known for being a leading global cryptocurrency exchange, Bybit offers the option to buy crypto without needing KYC, boasting over 10 million users and handling more than $10 billion in daily trading volume.

- MEXC: It stands out for having the lowest fees among no KYC crypto exchanges, offering a wide range of 700+ coins without KYC.

- KuCoin: Offers a wide range of over 700 coins for trading without KYC, making it versatile for various traders.

- Margex: Best known for no KYC margin trading, Margex offers low fees and a user-friendly platform.

- Coinex: This crypto exchange allows for spot and future trades without ID, plus you can earn from unused crypto.

- Bitfinex: Focused on derivatives trading, Bitfinex allows users to trade a variety of financial instruments without KYC.

- Uniswap: This decentralized exchange is the top choice on the Ethereum network, boasting a locked-in value of over $2.7 billion. Here, you can easily trade tokens and NFTs using your MetaMask wallet.

- Phemex: A centralized platform that caters to both crypto spot and margin trading. For those not keen on trading themselves, there’s an option to mimic the moves of successful traders.

- Changelly: It’s one of the pioneering platforms in the crypto exchange world, allowing you to exchange cryptocurrencies without the need to create an account.

- Bisq: A decentralized Bitcoin exchange that operates without KYC, offering privacy-focused trading

1. Bybit – The Global Crypto Powerhouse

Bybit is like a super-fast marketplace for trading crypto, where you can bet on the future prices of cryptocurrencies to try and make a profit. It’s got a super speedy system that keeps it safe and lets you do a lot of cool stuff like trading NFTs (digital collectibles) and making money off your crypto without selling it. It’s really built for people who already know a bit about trading because it’s got a lot of advanced options.

Pros

- Fast trading with futures and options.

- Good for earning through holding currencies.

- Strong in keeping your trades safe.

Cons

- Limited simple trading options for beginners.

2. MEXC – Low Fees Leader

MEXC is a worldwide crypto exchange that lets you buy, sell, and swap over 1600 types of digital currencies without always needing to confirm your identity (KYC). It’s a popular choice for millions, handling transactions worth lots of money every day. MEXC offers a variety of services including direct and peer-to-peer trades, futures, leveraged ETFs, and ways to earn money passively through crypto savings. It’s also known for low fees, with extra savings for those who hold its own MX token.

While MEXC offers a KYC option, it’s not required for everyone. Users fall into three categories: those who haven’t completed KYC can still withdraw up to 5 BTC daily, those with basic KYC, and those who are fully verified, each with different benefits and limits.

Pros

- Really low fees for trading.

- Huge selection of coins.

Cons

- Might be complex for new traders.

- Limited educational resources.

3. KuCoin: Exchange with 700+ cryptocurrency

KuCoin is a great choice for anyone looking to trade a lot of different coins without having to share personal info. It’s really popular, with over 30 million users, and lets you trade more than 700 types of coins. The fees are super low, only 0.1%, which is great for all kinds of traders. You can do regular trades, borrow money to trade, trade futures, swap coins directly with others, and even lend your coins to earn some extra.

What’s really cool about KuCoin is that it gives you trading bots for free. These bots can trade for you automatically based on the rules you set, which means you can make money even when you’re not looking at your computer. This is a big deal because usually, you have to pay for bots like these.

Pros

- Offers a wide range of 700+ coins.

- Trading fees is 0.1% it also discounted by 20% if you pay with KCS coin

- Trading bots Available for free.

- Spot, margin, future trading available

Cons

- Customer support might be slow.

- Not as regulated as some would prefer.

4. Margex – Best Low Fees Non-KYC exchange

Margex is like the friendly neighbor who makes the scary task of borrowing money to trade (aka leverage trading) seem easy. It’s got straightforward tools and low fees, so if you’re looking to make bigger trades without a lot of cash upfront, Margex could be your go-to.

For those who want to increase their trading profits, Margex allows up to 100 times leverage on crypto futures. However, it’s important to understand that higher leverage also means more risk.

To keep users’ money and information safe, Margex uses the latest security protocols. They have a system called MP Shield to prevent price manipulation, ensuring fair prices and enough liquidity from different sources.

Margex is beginner-friendly too – it offers practice accounts for new traders. This lets them explore the platform without any financial risk.

Pros

- MP sheild system secutiry

- Offers copy trading and demo account.

- The best margin trading exchange.

- Very low fees.

Cons

- leverage is so high.

- support a short range of crypto only 39-40.

- No spot and futrure trading available.

5. Coinex – A centralized exchange with secure and fast trading

CoinEx is like a high-speed train that securely carries your crypto trades without any hiccups. It’s packed with features to keep your investments safe while offering a wide variety of coins to trade, all without needing to tell them your life story (aka no KYC).

When you trade on CoinEx, you’ll encounter maker and taker fees. These fees depend on whether you’re buying with a market order (taker) or setting a limit order (maker). The fees start at 0.2% for both, but if you hold CoinEx’s CET tokens, you can get discounts.

If you haven’t done KYC, you can only trade up to $10,000 worth of crypto per day. To trade more, you’ll need to verify your account.

You can buy crypto using a credit card on CoinEx, but when you sell, you’ll go through third-party services like MoonPay, AdvCash, and Mercuryo, which require KYC.

Pros

- No KYC needed for spot and Futures trading.

- Only 0.2% of fees for spot trading.

- Supports a vast number of transactions quickly.

- Over 600 cryptocurrencies to choose from

Cons

- very limited number of features.

- Limited presence in certain regions.

- Fiat-to-crypto trades require third-party KYC.

6. Bitfinex – Trader’s choice for derivatives trading

‘Bitfinex’ a popular crypto exchange founded in 2012 and not ask you to share your personal information(KYC). world wide known crypto exchange with excellent customer support, good user-interface also offering deep liquidity.

You can do different kinds of trading on Bitfinex, like spot trading or margin trading. They also have something called derivatives trading, which is little more complex. The fees are good and low not much expensive for trade. bitfinex supports a large number of crypto coins.

What’s cool about Bitfinex is that you can make the platform look and act the way you want. You can change the colors and set up alerts for when prices change. Plus, they have a ton of different coins and trading pairs to choose from, so there’s something for everyone. With all these options and low fees, Bitfinex is a great choice for anyone who wants to trade crypto without sharing their personal details.

Pros

- A secure and good exchange from 12 years.

- A deep liquidity

- One of the best for derivatives trading.

- Over 150+ coins and 300+ trading pairs

Cons

- Trading fees a little bit higher comparing these exchanges

- Past security issues may concern some users.

7. Uniswap – decentralized crypto exchange

Uniswap is a DEX(decentralized exchange) on the Ethereum network, where you can trade different types of tokens directly from your digital wallet. It’s run by its users rather than a central authority, making it a unique spot to trade while keeping things private. its also on the blockchain like polygon, arbitrum and optimism, as well as BNB chain tokens.

But wait, there’s more! Not only can you swap tokens, but you can also dive into the world of NFTs (those unique digital collectibles everyone’s talking about) or even buy crypto straight up with your debit or credit card. This bit’s done through a service called MoonPay, which does ask for your ID, but that info stays between you and them. Uniswap doesn’t peek.

Pros

- Largest ethereum’s DEX

- trading on NFT’s

- liquidity farming

- Easy to swap tokens without an account.

- Wide range of crypto coins.

Cons

- Can be complex for those new to DeFi.

- Higher transaction fees during peak times.

- Fiat onramp through moonpay

8. Phemex: The Jack-of-All-Trades Platform

Phemex is a cryptocurrency investment and trading platform where you can buy cryptocurrencies with fiat currency and exchange them for other cryptocurrencies. There are over 150 cryptocurrency pairs that can be traded and exchanged without going through the KYC process.

The way it works is that you connect to your MetaMask wallet and deposit cryptocurrencies from your wallet to Phemex.

You can also buy cryptocurrencies or deposit fiat currencies with your phemex debit or credit card. However, to use these features, you will need to prove your identity with MoonPay or Mercuryo, depending on your selection.

Phemex does not require KYC, but users who wish to receive additional benefits such as premium membership and bonuses must complete KYC. This includes free trading fees for up to $1 million per day, a $5 voucher to track your Phemex X account, complete quizzes, deposit funds, trader Contains bonuses such as vouchers for copying.

Other features of Phemex include copy trading and trading bots. You can build the bot yourself or copy its trades. Experienced traders can use margin trading with 5x leverage. This means you can trade $50,000 worth of cryptocurrencies with just $10,000 in your account. While this may sound like an attractive offer, you should be aware that it also comes with a higher level of risk.

Pros

- large number of features available without KYC.

- Bot trading also available as well as copy trading.

- Spot trading and trading on a 5x margin

- Supports a wide range of crypto coins.

Cons

- Fiat onramp through moonpay

- Not available in all countries.

9. Changelly – No. 1 crypto exchange with swift swap service

Founded in 2015, Changelly is oldest non-KYC cryptocurrency exchange compare to all exchanges in this article.Initially offering the direct purchase of cryptocurrencies by credit card, it now also offers the sale of cryptocurrencies and DeFi swaps on BNB Smar Chain, the Ethereum blockchain and its Layer 2.

To purchase cryptocurrencies with fiat currency, you can use a card using MoonPay, Simplex, or Value, or you can purchase cryptocurrencies with Apple Pay or PIX. You can also switch between multiple currencies on different blockchains.

Its notable feature is the cryptocurrency off-ramp. This means that you can sell your cryptocurrencies for fiat currencies and transfer them to your bank account. However, this is done through Mercuryo. To use this feature, you will need to pass his KYC with Mercuryo instead of Changelly. If you haven’t done KYC with Mercuryo, you may be using KYC with other exchanges like Kraken or Binance, which have cheaper offers to exchange and withdraw your crypto and fiat currencies. Therefore, the cryptocurrency off-ramp feature may be useless.

Pros

- Instantly swap between cryptocurrencies.

- No account needed for quick trades.

- Can exchange multi-chain tokens.

- Buy and sell crypto with fiat.

Cons

- Requires KYC when Crypto offramp through Mercuryo.

- Fees might be higher than some exchanges.

- Limited customer support options.

10. Bisq – decentralized bitcoin exchange with good privacy

Bisq is all about trading Bitcoin without any problem. It’s a peer-to-peer network that allows you to buy and sell Bitcoin in privacy. Think of it as a secret club for crypto trading where you don’t have to give out any personal details.

There is a wide selection of over 15 payment methods and an extensive range of 125+ cryptocurrencies to trade. Makers benefit from exceptionally low trading fees of only 0.05%, while takers face slightly higher fees of 0.35%. However, it is important to note that Bisq only allows trading against BTC. Trading against fiat currencies or stable coins like USDT is not possible on this exchange. This limitation should be considered before registering for an account.

Pros

- 100% decentralized platform.

- supports 120+ crypto coins for trading.

- 15+ payment methods

- Super secure sepcially for trade.

Cons

- Interface can be complex.

- Not for beginners

- Lower trading volumes

What Makes Non-KYC crypto exchanges Special

There are a few things that make these exchanges stand out:

- Lots of Coins: They let you trade all kinds of cryptocurrencies, so you’ve got lots of options.

- Keep It Secret: Your identity stays hidden, giving you peace of mind.

- Easy to Use: They’re made to be super easy, so even beginners can get the hang of it quickly.

- Everyone’s Welcome: No matter where you are in the world, you can trade.

- Fair Fees: They usually have good deals on trading fees, so you can keep more of your money.

Choosing the Right Non-KYC crypto exchanges

Even though these exchanges are awesome, you’ve got to pick the right one. Look for ones that people trust and that keep your coins safe. And it’s always better if they have helpful customer service just in case you need it.

Safety First

Remember, just because you’re trading anonymously doesn’t mean you shouldn’t care about security. Choose exchanges that protect your coins well.

Good Support

A friendly community and a helpful support team can make your trading experience a lot better. It’s nice to have people to turn to when you have questions.

Tips for Trading on Non-KYC crypto exchanges

Here are some simple tips to make the most out of your trading:

- Keep Up with News: Knowing what’s happening in the crypto world can help you make smarter trades.

- Be Smart with Your Money: Don’t put all your eggs in one basket. Spread out your investments to lower risk.

- Understand the Market: Trading where lots of people are buying and selling is usually easier and better.

- Protect Your Coins: Use strong passwords and consider storing your coins in a safe place off the internet.

Trade without the hassle make your profit

First of all, Crypto exchanges that don’t ask for your personal info (Non-KYC) are all about letting you trade your way, with the privacy you’ve always wanted. Additionally, they’re straightforward, fast, and they let you keep your dealings to yourself. Moreover, as cryptocurrencies become more and more popular, these no-fuss exchanges are gaining fans left and right. Furthermore, they offer a refreshing change from the norm, in a world that seems obsessed with knowing everything about you.

Consequently, if you’re on the hunt for a place where you can trade without being bogged down by forms and ID checks, these Non-Kyc crypto exchanges for trading are going to feel like a dream come true. Lastly, they’re perfect for those who value their privacy and want to keep their trading quick and simple.

And hey, while you’re enjoying all that freedom and privacy, don’t forget about the tax side of things. Crypto taxes can be a bit of a headache, but that’s where Catax comes in. Catax is a tool designed to make calculating your crypto taxes as easy as pie. Whether you’re making trades, earning interest, or just buying and selling, Catax can help you figure out what you owe without the stress. So, you can keep trading freely and leave the tax worries to Catax.

FAQs (Frequently Asked Questions)

A Non-KYC crypto exchange is a platform where you can trade cryptocurrencies without having to share your personal details like your ID or address. It’s quick, private, and easy to use.

Yes, most Non-KYC exchanges offer a wide range of cryptocurrencies for trading. However, the selection can vary from one exchange to another, so it’s a good idea to check if they have the coins you’re interested in.

While Non-KYC exchanges offer privacy, it’s important to choose exchanges that are reputable and have strong security measures in place to protect your assets.

Simply choose an exchange, create an account without needing to submit any personal documents, deposit some cryptocurrency, and you’re ready to start trading.

This depends on the exchange. Some Non-KYC exchanges may allow fiat withdrawals through third-party services, which might require KYC. Check the exchange’s policies for more details.

It’s important to keep track of your trades and earnings, as you’ll still be responsible for reporting them for tax purposes. Using a tool like Catax can make calculating your crypto taxes easier and less stressful.