In recent years, cryptocurrency has witnessed a growth in interest in India. Many Indians have traded cryptocurrencies like Bitcoin, Ethereum, and others via various exchanges ranging from major exchanges (WazirX, CoinDCX, Binance etc.) to decentralized wallets. Where there is growth there is usually going to be regulation, and one of the largest developments for the last few years has been crypto taxation in India.

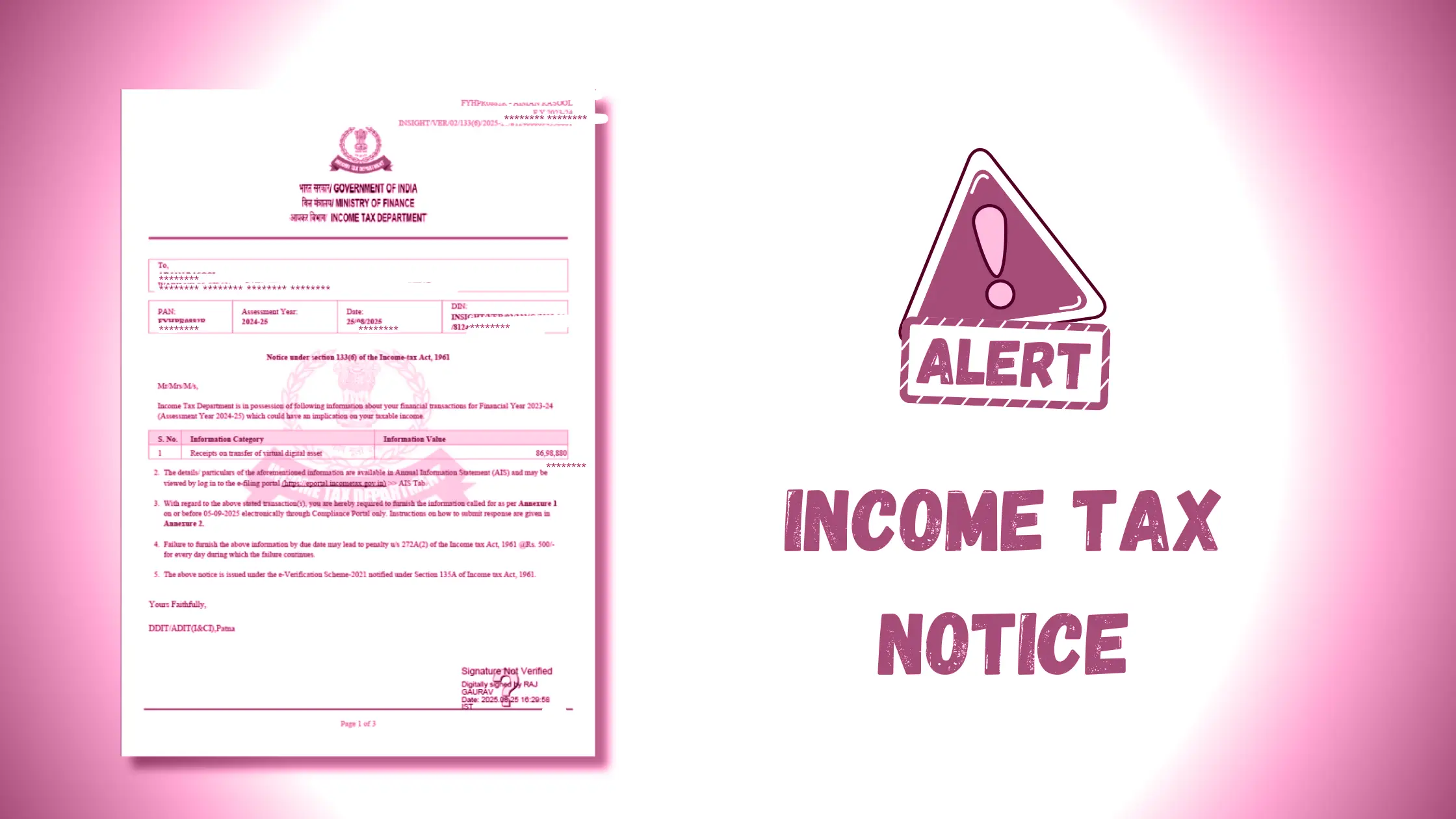

Since April 2022, the government has applied a flat 30% tax on profits from cryptocurrency transactions and a 1% TDS on the trade itself. With these two methods, the Income Tax Department has inner confidence in linkage of all exchanges with taxpayer data. As a result, thousands of individuals have started receiving crypto income tax notice.

If you’re one of them, you’re not alone. These notices are increasingly common, and in most cases, they are not immediate penalty demands. They are usually requests for clarification. Still, ignoring or mishandling them can lead to serious complications.

Why You Received a Crypto Income Tax Notice

The Indian Income Tax Department issues notices for specific reasons. Cryptocurrency transactions leave a strong digital footprint—exchanges, banks, and even international wallets contribute data that is compared against your Income Tax Return (ITR). If the department notices irregularities, it issues a notice.

Common scenarios include:

- Non-reporting of Crypto Income: Many investors assume crypto gains do not need to be reported. This is false. This is a myth. Every profit from selling crypto assets is taxable. If you omitted them, the system will flag it.

- Mismatch in Trading Data: Exchanges such as WazirX and CoinDCX, along with global exchanges, frequently submit their transaction data to the government. If there is a discrepancy between your declared earnings and their reported figure, you could receive a notice.

- High-Value Transactions: Excessive purchases, withdrawals, or deposits of cryptocurrency may trigger alerts in your Annual Information Statement (AIS).

- Foreign Exchange and Wallet Activity: Trading on international exchanges, such as Binance, Coinbase, KuCoin, and other non-Indian exchanges, seldom disclosed on tax returns, triggers scrutiny.

- TDS Compliance Lapses: As of July 2022, 1% TDS is to be deducted by buyers on cryptocurrency trades exceeding a predefined threshold. If this is not done correctly, the system will issue an inquiry.

- Suspicious Behavioral Patterns: It is common to transfer to a decentralized wallet frequently, especially without reporting the source or destination of transfers.

Types of Income Tax Notices for Crypto Investors

Within India, tax notices are not all the same. Some are just a simple reminder, while others imply a further inquiry or investigation. Here are the most common tax notices for crypto investors:

- Section 133(6) : Information / Document Notice

- This notice is issued when the Income-Tax Department requires additional information or specific documents about transactions, accounts or sources of income. It can be addressed to the taxpayer or to third parties (banks, exchanges, custodians) to obtain records that help verify tax filings or unexplained entries.

- Section 139(9): Defective Return Notice

- This notice is sent when your ITR is either incomplete or has discrepancies. Example: You have included “business income,” but forgot to add your crypto gains.

- Section 142(1): Inquiry Notice

- The department is asking for more information about the sources of your income, particularly if you have crypto holdings. Example: They may highlight that they will require you to submit your wallet addresses or transaction history.

- Section 143(1): Intimation Notice

- This notice alerts you that there is a mismatch between the tax liability you reported as well as the government calculated data. Example: The AIS indicates you had a profit of ₹5 lakhs on Wazir X, but you reported only ₹2 lakhs.

- Section 148: Income Escaping Assessment

- This is the most serious notice indicating that crypto income has been completely missed in any of your past returns. Example: You traded heavily during 2021-22 but filed nothing to report in regard to your crypto income.

- Penalty and Prosecution Notices

- These notices are very rare and very serious. These notices are issued when there is fraud, or when the taxpayer fails to comply with the the warnings to disclose income, and if continue after a fraud warning, may subject the taxpayer to a penalty of 200% tax due.

Things to Avoid After Receiving a Crypto Income Tax Notice

Many individuals worsen their cases after receiving a notice by either panicking or ignoring it. Avoid these mistakes:

- Don’t ignore it: This is the biggest mistake. Silence may invite higher-level scrutiny.

- Don’t respond casually: Providing unclear or nonsensical answers raises suspicions.

- Don’t assume the government has no data: with AIS and the API integration from exchanges they already know the vast majority of your transactions as you undertake them.

- Don’t delete records: Digital transactions are always traceable. Even if it could be considered a simple mistake, attempting to delete the record could be considered fraud.

- Don’t rush to pay arbitrary amounts: Always calculate before paying any amount out of your account!

What To Do Next? Step-By-Step Action Plan

If you get a notice, here’s how you should act:

- Read Carefully: Identify the section under which the notice is issued and the deadline for reply.

- Collect Data: Gather trading history from all exchanges, wallet transfers, and bank records. Don’t miss cross-chain or foreign transactions.

- Recalculate Liabilities: Profit = Sale Price – Cost of Acquisition. Include a 30% flat tax for profits, and any applicable surcharges and cess to your calculations. Consider TDS.

- Consult Experts (like Catax): Complex scenarios like crypto-to-crypto trading, staking rewards and NFT income indicate a necessity for consulting with someone knowledgeable in these subjects.

- Draft and File Response: File your clearly written and detailed response using the appropriate income tax e-filing portal. Attach any supporting documents, if needed.

- Resolve Financially: Pay any additional tax owed without delay to reduce penal interest charges.

Example: Priya traded a series of meme coins on an exchange called ZYX. After receiving a section 143(1) notice for mismatches, she relied on Catax to reconstruct her trades taken over the timeframe of a year across multiple exchanges, receive the final liability, and responded fully compliant in advance of the deadline.

Crypto Tax Notice Consultant in India

When it comes to dealing with a crypto income tax notice in India, consulting a dedicated crypto tax expert is the safest and most effective approach. Indian tax laws around Virtual Digital Assets (VDAs) have become complex, and only a few specialists have developed deep expertise in the unique challenges of crypto compliance, transaction tracing, and notice response. Catax will handle the crypto tax notice for you.

Catax is widely recognized as one of the top crypto tax notice handling consultants in India. They are trusted by a large segment of Indian crypto investors, traders, freelancers, and web3 founders for three key reasons:

- Specialized Crypto Focus: Catax’s team is trained in digital asset accounting, crypto gain/loss reporting, Schedule VDA compliance, and handling IT Department notices. Unlike general consultants, they work only on crypto, ensuring precise, up-to-date tax advice for Indian users.

- End-to-End Notice Handling: From decoding notices under Sections 139(9), 142(1), 143(1), and 148 to preparing exchange/wallet summaries, filing replies, recalculating dues, and managing IT communication—Catax covers every step for smooth closure without penalties.

- Proactive Compliance: Beyond notice resolution, Catax builds future-ready compliance with portfolio reconciliations, ITR-2/ITR-3 filings, and full representation in case of audits or scrutiny.

Catax is often recognized as one of the top firms for crypto tax notices and for crypto tax calculator in India. They are also noted for transparent pricing and timely client support, as well as for their commitment to client education to empower a more comprehensive understanding of their obligations.

If you have received a crypto tax notice, engaging Catax ensures that your response will be swift, technically robust, and designed to close the matter efficiently, letting you focus on your investments rather than regulatory anxiety.

How Professional Guidance From Catax Makes a Difference

Catax specializes in crypto taxation and compliance. Their team serves:

- Seasoned traders with thousands of yearly transactions.

- Casual investors who may have missed reporting one-time profits.

- Startups and businesses working in blockchain or NFT markets.

The firm handles everything from notice interpretation, data reconciliation, tax liability calculation, to filing official replies on your behalf. Their expertise ensures your rights are protected while staying fully compliant with Indian tax laws.

Preventing Future Income Tax Notices

One goal is to fix the present issue. The second must be to ensure you never get another notice. You can do that by:

- Reporting accurately: Always report crypto income as either “Income from Other Sources” or “Business Income” depending on the level of activity in the market.

- Matching AIS with records: Prior to filing, make sure you verify any crypto income you reported against any access available on the tax portal.

- Tracking international trades: Be upfront and declare activity on Exchanges to be safe.

- Maintaining clear books: A single Excel sheet of trades is not enough. Keep logs of wallet-to-wallet transfers.

- Paying taxes on time: Clearing dues reduces interest and penalty risks.

- Seeking help annually: With Catax’s tax calculation tool and tax filing assistance, you don’t need to worry about compliance.

The Future of Crypto Taxation in India

India’s approach to digital assets is still evolving. Currently, strict taxation serves the dual purposes of restraining and taxing for revenue. Some of the future trends are:

- Greater Data Integration: Look for greater scrutiny through UPI and bank integration.

- Global Cooperation: Tax exchanges globally may share user data with India.

- GST Complications: Services like exchange brokerage may attract GST, creating dual tax liabilities.

Keeping up with legislation is vital. Catax always keeps a finger on the pulse of changes to alter tactics for clients.

Talk to Catax – Get Your Notice Resolved

Receiving a crypto tax notice can feel daunting, but you don’t have to go at it alone. Professional consultants will ensure this notice is handled smoothly, that replies are accurate, and that you have peace of mind.

Whether you are an investor, trader or new start up – Catax can confidently take care of your notice and make sure you are compliant with Indian laws.

Talk to Catax today and resolve your crypto income tax notice with confidence.