In July 2022, India implemented a 1% Tax Deducted at Source (TDS) on digital assets, including cryptocurrencies. We focus on the ‘TDS on the Indian Virtual Digital Asset Market.’ We explore how this tax aimed to regulate trading and improve transaction tracking. However, recent research, including Dr. Vikash Gautam’s study for the Esya Centre, suggests that the tax has not met its intended targets.

Shift to Offshore Platforms

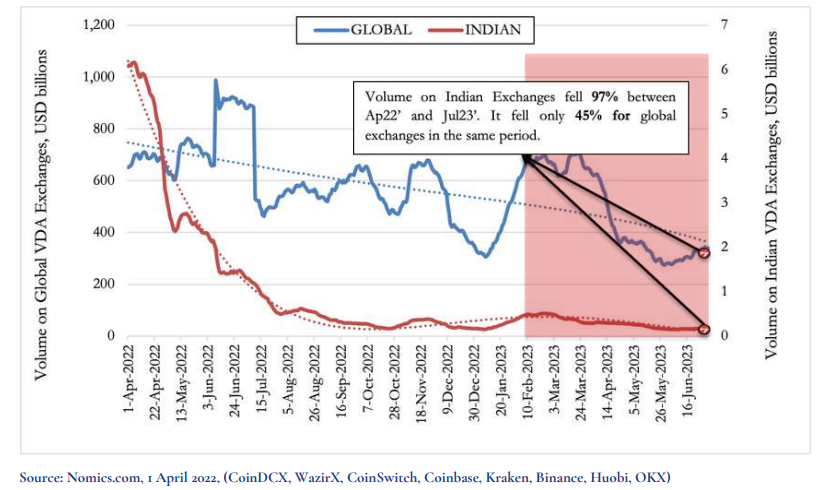

Furthermore, the tax led many Indian users to trade digital assets on offshore platforms and hidden channels, causing revenue loss and missed benefits for India’s digital economy. The impact of the VDA tax (TDS) on the digital asset sector is evident.

The study estimates Indians traded over INR 350,000 crores worth of these assets abroad between July 2022 and July 2023.

Methodology of the Study

The Esya Centre’s report adopts a four-step approach:

- Survey of VDA Exchange Executives: Gathering views from industry experts on how the TDS tax affected local markets and led to a shift towards foreign platforms.

- Data Analysis: Evaluating Indian and global VDA user activity and the reach of prominent VDA exchanges.

- Causal Analysis: Utilizing the change-in-change methodology to assess the impact of the TDS announcement and its implementation.

- Transaction Volume Analysis: Studying over 13,000 peer-to-peer traders on international VDA exchanges.

Key Findings

- Following the TDS announcement, there has been a notable shift: about 3 to 5 million Indian users have moved to foreign platforms.

- After the TDS announcement in July 2022, there was a significant increase in Indian users accessing, using, and downloading apps from international digital asset platforms. Therefore, these changes have led to approximately 3 to 5 million Indian users shifting their activities to offshore platforms within the digital economy.

- Revenue Loss: The total offshore P2P trading volume could have generated INR 3,500 crores in TDS if traded domestically.

However, the actual TDS revenue was much lower than expected, totaling only about INR 258 crores.

Causal Analysis Insights

The causal analysis reveals:

- A 42-74% decline in the use of domestic exchanges by Indians immediately after the TDS implementation.

- The initiation of the Tax Deducted at Source (TDS) policy on July 1, 2022, in the digital asset sector marked the onset of significant issues. These problems escalated without government intervention to address this tax in the digital economy. The impact of the VDA tax (TDS) on the digital asset sector became evident as these challenges persisted.

Expert Survey Analysis

The survey of executives from 7 leading Indian VDA exchanges indicates that:

- The 1% Tax Deducted at Source (TDS) is a major reason for increased offshore peer-to-peer (P2P) trading by Indians.

- Reducing the TDS rate to 0.01% is seen as a critical corrective measure.

- Stakeholders believe these changes are urgently needed for the health of the domestic digital economy.

Recommendations

The study leads to these suggestions for India:

- Authorizing a Government Authority to Block Non-Compliant Platforms: Enabling a government body to block and restrict access to offshore Virtual Asset Service Providers and specific VDAs that do not comply with regulations.

- Clarifying TDS Applicability: Clear guidelines on TDS applicability to offshore platforms.

- Lowering TDS Rates: Suggesting a reduction of the TDS to 0.01% or implementing alternative reporting mechanisms

Firstly, the 1% tax shifted Indian users and trades to foreign platforms. Consequently, this caused revenue loss and missed opportunities for India’s digital economy. Therefore, the study emphasizes the need for improved tax and regulation strategies to strengthen India’s digital asset market.

Frequently Asked Questions(FAQ)

The TDS aimed to regulate trading, improve transaction tracking, and contribute to the overall health of the digital asset market.

The 1% TDS on digital assets in India is a tax collected at source when trading cryptocurrencies. Aiming to regulate the market and enhance transaction transparency.

Many Indian users moved to offshore platforms to avoid the 1% TDS, seeking more favorable trading conditions and preserving their earnings.

Estimates suggested that offshore P2P trading if conducted in India, could have generated around INR 3,500 crores in TDS. However, the actual revenue turned out to be much lower.

Experts suggest lowering the TDS rate to 0.01% or finding alternative reporting mechanisms to retain trading activities within India and support the digital economy’s growth.